Our technology

The Piprate tech stack is enterprise grade, combining cutting-edge blockchain technology with the most robust security and encryption measures on the market. Serving an ecosystem of insurance data products and applications, Piprate is supported by a distributed data sharing layer and a unique data model perfectly suited for distributed applications.

Platform architecture

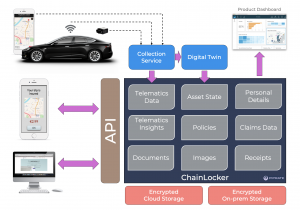

Data Sharing Layer: ChainLocker

ChainLocker is core data sharing service that exposes an API to interact with the platform, accepting data storage, sharing and retrieval requests.

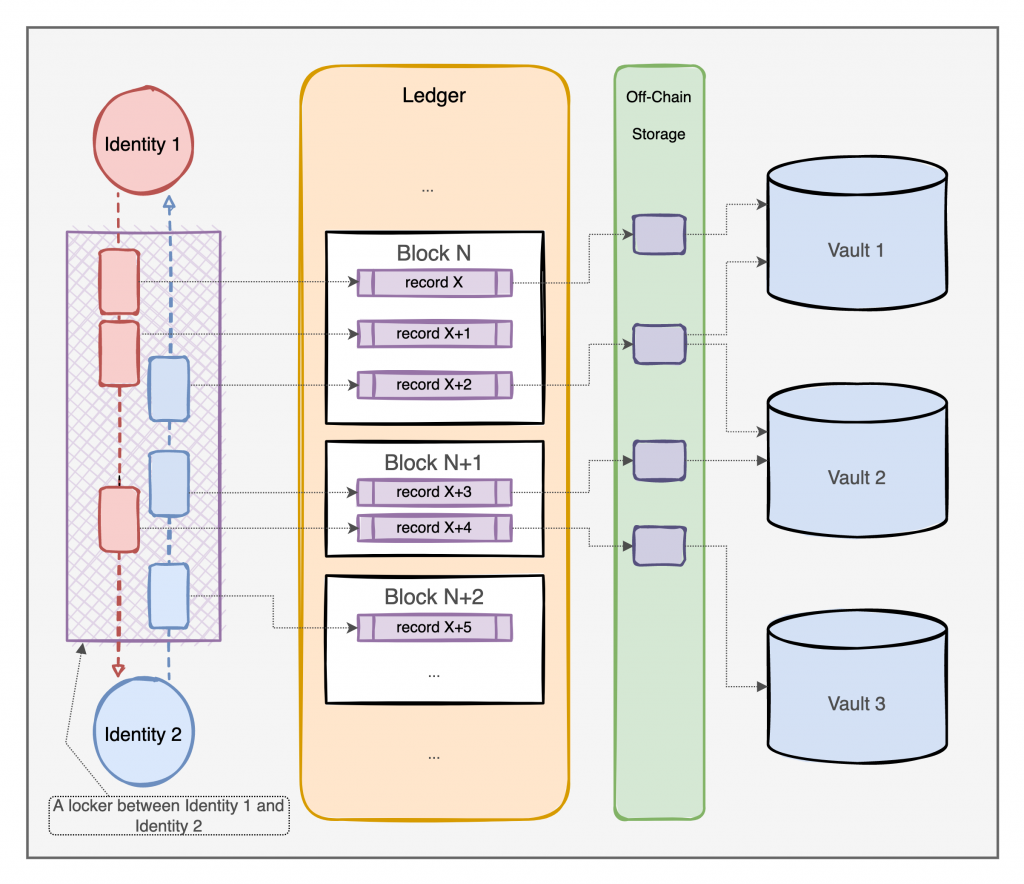

- The Distributed Ledger stores a consistent and unambiguous ‘state of the world’ to ensure all platform participants get the same view of data. Each record on the ledger represents a data transaction, such as submission, sharing, updates/ relationships, or consent revocation. The Distributed Ledger is shared and available to all platform participants. Piprate is blockchain-agnostic, offering the ability to run on a variety of blockchains, including Hyperledger Fabric, Flow or even AWS S3 storage or a relational database.

- Off-Ledger Data Storage stores encrypted metadata about specific data transactions. This metadata is only available to transaction participants. Piprate’s modular design support a number of storage technologies, but we recommend using IPFS.

- Corporate Data Storage (ChainLocker Vaults) is the main storage layer for stored/ shared data. Data is secured via an AES-256 based end-to-end encryption solution, and only participants in the data sharing transaction are able to decrypt the data.The ChainLocker Vaults are generally controlled by the primary beneficiaries of data they store. Vaults can be based on various storage technologies, including file systems, cloud storage, IPFS or any web services that serve data. We discourage interacting with databases directly.

Insurance industry participants interact with the platform using a web application and an API (for system integration), connected to the DLT network via a ChainLocker Node.

Digital Twins

Digital twins act as a “single source of truth” for all relevant parties, including brokers, the carrier, eventually, reinsurers, and, most importantly, the insureds.

Digital twins accumulate various sources of information, from proposal forms and policy documentation to claim submissions and third-party insights to build up the most comprehensive view of risk.

Exposure Exchange

We offer a secure cloud-based app for reinsurance brokers and (re)insurers to streamline exposure and data sharing across the supply. It allows exchanging exposure data and other documentation while negotiating reinsurance contracts, validates provenance, facilitates data augmentation and delivers a secure channel for bidirectional access to essential datasets.