How Piprate works

Learn how Piprate works: an InsurTech platform that helps re/ insurance actors to exchange data in a trusted way, providing full transparency and accountability.

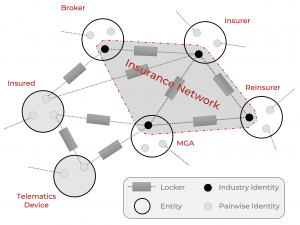

Piprate provides participants with secure blockchain-enabled data wallets. Each data wallet contains a list of all the data artefacts available to its owner, either through sharing or ownership. These artefacts are available though lockers that permanent, bidirectional communication channels with one or more participants.

The data wallets integrate seamlessly with existing internal systems via cryptographically secure APIs. Piprate clients never give up custody of their data, meaning they have full control over where the data is stored.

Once the data is shared, the terms and conditions of this operation are immutably recorded on the ledger for full transparency. Should a data owner wish, they can revoke access at any time.

Data is ready and available for analysis at any time; any subsequent changes due to cleansing or augmentation are automatically folded into an immutable chain of provenance for future use.

This provenance chain, in combination with additional metadata, links different data sets into a global knowledge graph, providing the most detailed picture of insurance risks (and many other types of information) in a secure and compliant way.