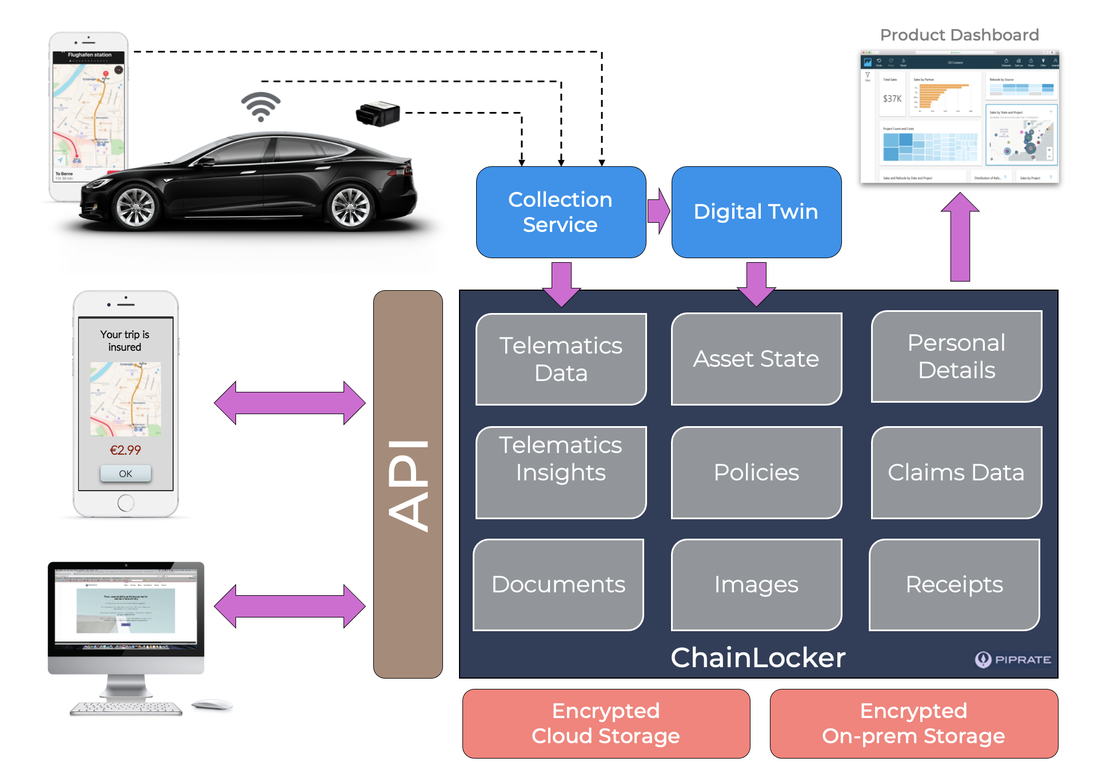

Piprate helps brokers, carriers, reinsurers, and insureds exchange insurance data in a trusted way - with full transparency, auditable history, and strong access control - so critical workflows move faster without compromising security or compliance.

The problem Piprate solves in insurance

Insurance data is valuable - but it’s often trapped in fragmented systems and moved through insecure, inefficient channels (spreadsheets, email, manual re-processing). That creates three persistent issues:

- Low trust in data provenance and quality

- Slow, repetitive operational cycles

- Cybersecurity and compliance exposure

Piprate replaces ad-hoc transfer with a secure, governed data exchange layer built for ecosystem collaboration.

Typical insurance use cases

- A secure storage backend for a modern insurance applications, protecting sensitive customer data while enabling controlled sharing with authorised parties when required

- Reinsurance exposure submission and contract negotiation workflows

- Claims collaboration with provable provenance and controlled access to supporting evidence

- Secure third-party data augmentation (risk insights, verification, enrichment) with traceability